Hit Enter to Search or X to close

How

Family Offices

use the Novus Platform

Aggregate your allocations across equity, credit/fixed income, private equity, real assets, and more. Harmonize multiple transparency levels to achieve unified visibility into your entire portfolio.

Uncover the impact of hypothetical transactions. What if I redeem from this manager? What if I increase my allocation here? Use data to asses your intuition, before committing.

Research historic portfolio performance and measure manager uniqueness using global ownership data. Uncover true drivers of performance with skill-set analytics. Monitor managers over time, and watch for style drift.

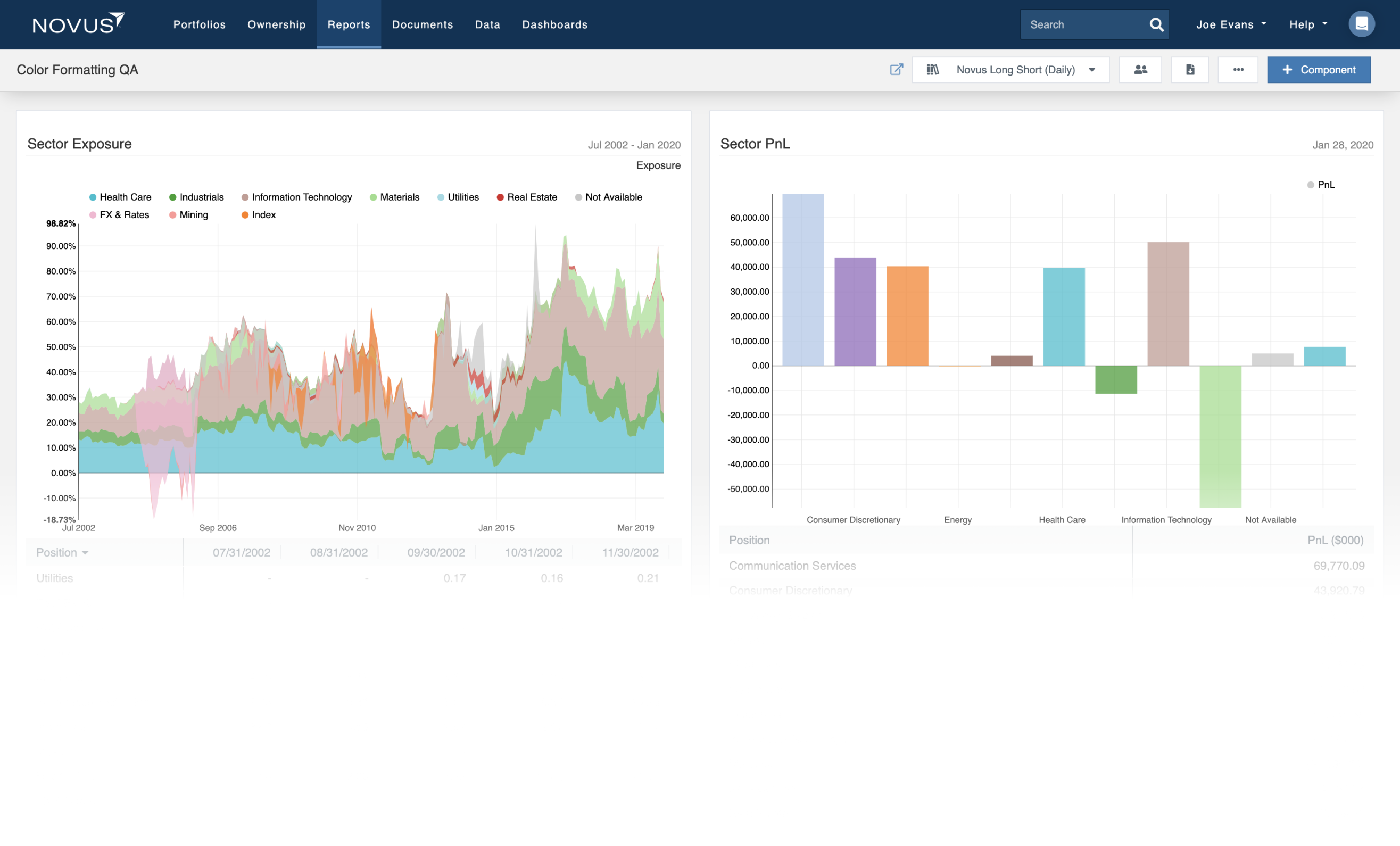

Automate reports so you can focus on what you do best—making investment decisions. Tailor reports to match your unique needs, add your logo and brand colors, and then schedule automatic updates to send to stakeholders.

Analyze your exposures by strategy, geography, sector, market cap, or set custom categories. Drill down and view your underlying positions. Drill-down further and see who contributes to those positions. Go “top to bottom” in just seconds.

How

Family Offices

use SEI Novus

Industry-leading tools for exposures, P&L, contribution, and ROIC. Go beyond top-level metrics to better understand your skill sets; derive batting averages, capital-allocation ratios, win/loss ratios, and sources of alpha.

Automate internal reporting to streamline and maximize internal efficiency. Create completely custom reports, then add your logo and brand colors to communicate your story to stakeholders in a highly differentiated way.

Slice and dice your attribution by the variables that matter most to you. Decompose your contribution by analyst, by theme, by asset type, or any other factor.

Visualize your portfolio’s sensitivities to customizable factors; choose from market, size, value, momentum, shifts in the yield curve, oil, commodity prices, and many more. Discern how these factors have performed and how they contribute to your P&L.

Search, analyze, and track 10,000+ institutions across hedge funds, mutual funds, investment advisors, and other institutional investors. Analyze your own portfolio’s crowdedness compared to the industry, and measure overlap with peers.

Smooth Onboarding

We navigate complex integrations via careful planning, rigorous follow ups, methodical execution. Maintaining an open dialog the whole way.

Qualified Professionals

We recruit and train former investment professionals who understand the nuances of the industry and your needs. Acting as an extension of your team.

Attentive Partnership

We live by responsiveness, a focus on the long-term, and being adaptive to shifting priorities. Partnering for maximum impact.

Who Uses the Novus Platform at

Family Offices

Who uses SEI Novus at

Family Offices

Client Assets Under Management

& Assets Under Advisement

Worldwide (North America, Europe, Asia, Africa)

Experience Serving Institutional Investors

Learn how SEI Novus can help you.

Our team of world-class client management analysts will introduce you to our product, tailoring the conversation to your specific needs and interests.