GME and Planning Your Response with Novus

Internet investors from Reddit and Discord play chicken with hedge funds as GameStop (GME) draws all eyes. What does it mean for allocators?

It's unavoidable. Whether you want to or not, by now you've seen dozens of news articles, tweets and op-eds on "Short Squeeze," "Reddit," and "MemeStocks." Journalists worldwide are stumbling over each other to explain the GME drama. But the questions racing through the mind of a multi-billion dollar CIO—responsible for an endowment, foundation, or pension perhaps—are very different:

"What is my exposure to GME via my fund allocations?"

"What can I expect for the upcoming 13F 2020 Q4 filings?"

"How should I be rearranging my allocations, if at all?"

Novus can get you the answers you need in seconds. We extract, clean, and enrich public 13F data daily, enabling effortless access to insights. Read on, and follow along with this free research dashboard we've spun up using public data:

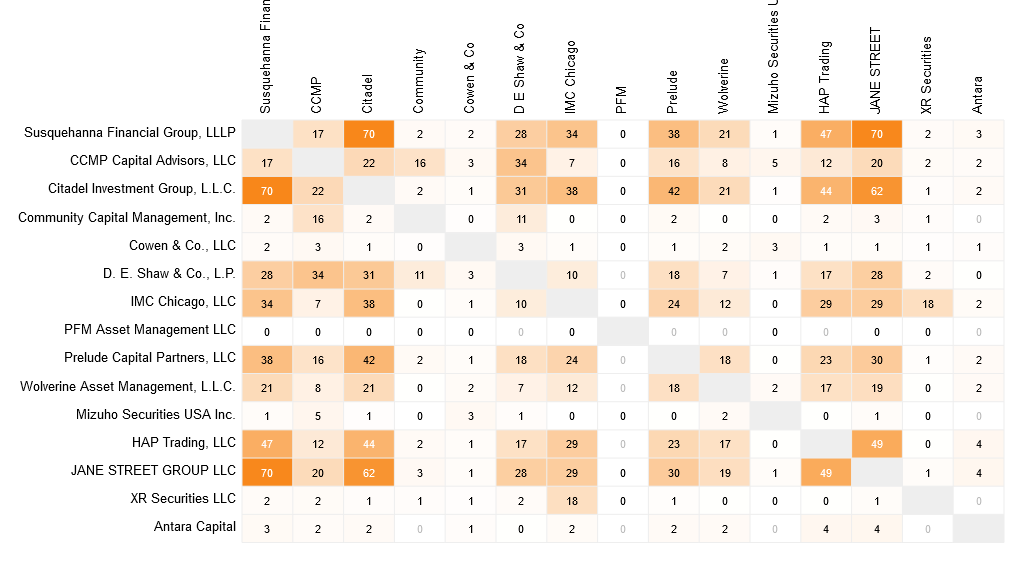

Finding peers with Overlap Analysis

First, we want to examine all hedge funds and other entities that held GameStop (GME) as of their 2020 Q3 13F reporting. A reminder: this data is all freely-available, collected by the SEC and published on its website quarterly. As part of its Public Platform offering, Novus extracts, normalizes and enriches this data with returns simulations, updated daily.

While the data doesn't include short positions, it does include put options holdings, which give us some insight into firms that may have an aggressive stance for or against GME. (If you're an allocator, make sure you get position-level transparency from your manager on Novus to see their real shorts!)

Using Novus, we build an overlap matrix consisting of GME options holders. Everyone has heard of Melvin Capital by now, but let's look at what other firms are being hit hard—or surging—in the wake of these market events? This matrix serves as a starting point:

Dark orange cells indicate overlapping holdings, white indicates no overlap, and green indicates opposing holdings. The darker the color, the more pronounced the correlation/opposition.

We immediately see that there are firms not-so-much in the news, like North Fourth and Maplelane Capital, who have relatively close overlap with Melvin. Conversely, we see that Wolverine Trading had the most opposite overlap with Melvin (-12%).

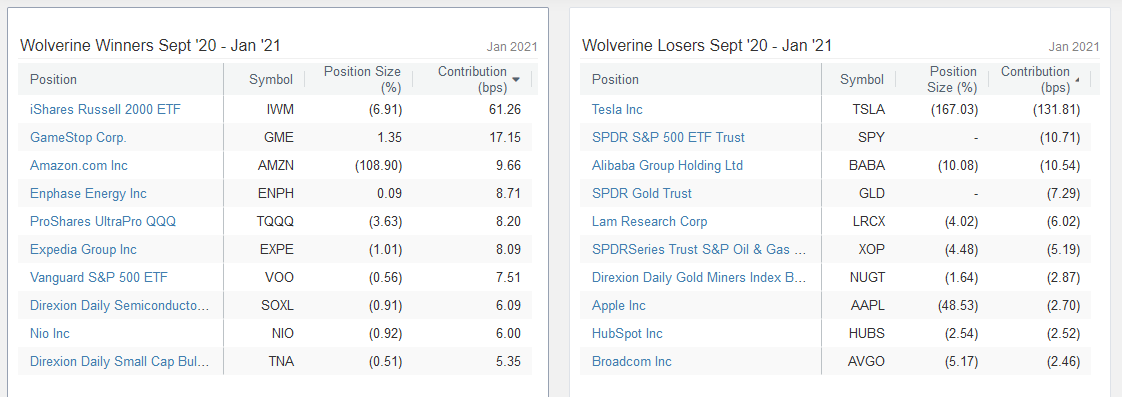

Let's explore each of these managers. Using Novus, we can dive into the firm and examine their exposure and performance in individual names. In a few seconds, we can build a dashboard showing the top 10 winners and losers for each firm, yielding a couple of surprises...

Maplelane Capital

We can see from Figure 1 that Maplelane's and Melvin's strategies overlap by 38%. A quick Internet search reveals that similar to Melvin, Maplelane is also down 30% for the month. Below we can see recent winners & losing (long) names.

North Fourth Asset Management

North Fourth looks to have a huge upside from recent events, having a huge long position on GME and a whopping 1,807 bps of market value-based return on that name alone since Sept 2020 (provided they held).

Wolverine Trading

Meanwhile, Wolverine Trading has a modest long position in GME, but a sizable short bet in Tesla (TSLA).

Drilling deeper into Wolverine's 13F reporting, we find that this firm has taken aggressive Put Option positions against a variety of high conviction names. Clearly not one to follow the crowd!

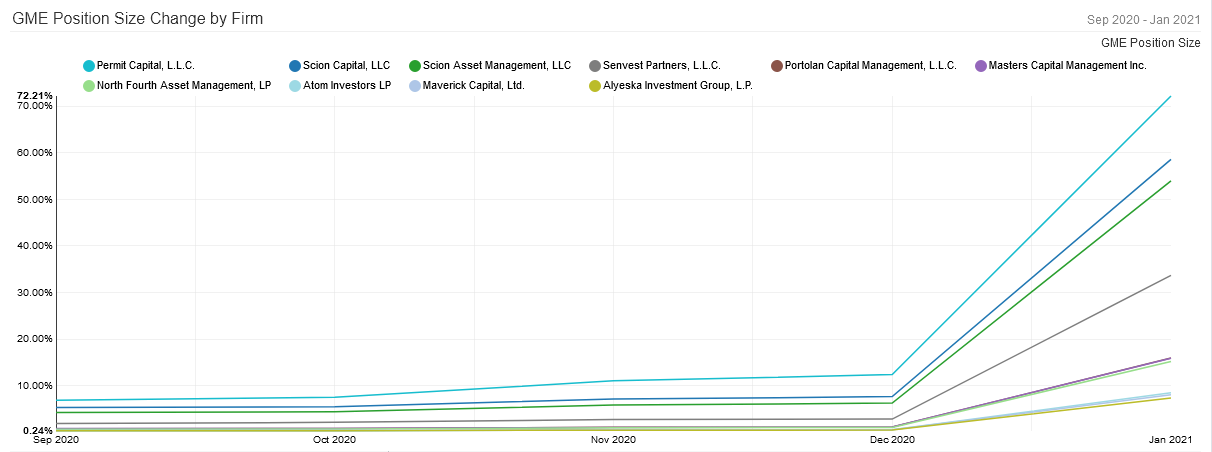

Which managers benefitted from GME?

A lot of the news has focused on doom and gloom, but what about names (and funds) that are seeing upside in current market conditions? The Novus Hedge Fund Universe, a group of funds that Novus maintains for analytics purposes, aggregates 13F-reported holdings across all hedge funds. Using this group of portfolios, we can quickly discover which firms have likely seen the greatest upside from holding GME.

One that stands out from the list is Permit Capital, a manager who has taken an activist role in GameStop. Recent GME momentum has meant Permit's original position size of 6.55% has grown to represent 72.21% of Permit's portfolio, and resulted in an eye-popping 24,646 bps of market value-based return on the name alone since its 13F reporting last September. If you have allocations into Permit Cap, you're effectively investing directly into GME.

What about AMC?

Of course, GME is just one name in the news. Another is AMC, which also has seen ridiculous gains in recent days thanks to grassroots internet organizing. From here we can also build an overlap matrix of options holders as a jumping off point for similar exploration. We see some familiar names from the GME holder matrix, and a few new names. We'll leave further exploration as an exercise to the reader.

Stay tuned...

Keep in mind that this data is from the previous 2020 Q3 13F filings, reported in September. In a few short weeks, 2020 year-end filings will be available and Novus will have updated holdings on its platform. This picture could look entirely different by then. And of course the Novus client services team will be on hand to help you pour over the data and build reports most relevant to your investment objectives.

In the meantime, savvy allocators should be using all the transparency available to plan their portfolio adjustments. As it happens, Novus has tools to assist with this too! As a Novus user, you can import your existing fund allocations and mix in the best-available position transparency to gain a unified look-through of your actual position exposures, with update daily return simulations. You can also build a multiple investment scenarios to plan your allocations to current and potential funds, including full transparency into their holdings, hopefully avoiding the next GME blow up.

In a future article, we'll explore how these tools can help you build your next portfolio in minutes.

See you soon!

.png)